Heavy duty & off-highway Diesel Fuel Injection

- Product Information

- Product Resources

- Enquire

- Related Products

Rich OE legacy

Our heritage dates back to the legendary CAV brand, and the introduction of in-line and the iconic DPA pump – the best-selling rotary pump worldwide. Both were revolutionary for their time, setting new standards for reliability and power, and we’ve continued to push the boundaries ever since.

Three choices for fleets

By providing three choices – new, reman and repair – we can provide fleet managers with convenient service and maintenance at a very competitive cost.

Latest generation OE technology

Our latest generation F3 system takes engines beyond the 2021 global emissions and fuel economy regulations and through the next decade. Based on our proven Euro VI Common Rail technology and capable of 3,000 bar injection pressure, it delivers a substantial improvement in emissions, fuel economy and refinement for the lifetime of the engine.

OE-approved repair

In addition to new and remanufactured units, we also offer authorised repair through our global network of Delphi Diesel Centres. Replacing all wearable and performance critical parts, with like-for-like OE, and using OE-approved test plans and equipment, it offers a quality but economical solution.

Find your local diesel specialist here.

Reman

For an equally fast, yet more cost-effective turnaround we offer a range of remanufactured parts. Available off-the-shelf, typically within one to two years of vehicle launch, they are built using OE parts, equipment and processes, and are calibrated to exacting OE specifications.

OE expertise in the aftermarket

Of course, we’re committed to supporting these technologies in the aftermarket. We offer a range of new OE components, identical to those originally fitted, including our pioneering Electronic Unit Injector, Electronic Unit Pump, Smart injector and Multec® Common Rail.

Commercial vehicle diagnostics and test

Our dedicated diagnostic solution for trucks, buses and trailers, supports the key commercial vehicle manufacturers and systems, including the ability to carry out dosing tests, Adblue freeze monitoring calibration, system drain down and regeneration of the SCR system. We also offer a range of OE-approved test equipment for quick and accurate test and repair of the latest heavy duty applications.

Training from the OE experts

Designed to help you prepare for the very latest heavy duty diesel fuel injection technologies, our extensive training programme covers the repair of key systems, including Electronic Unit Injector and Pump and Smart injectors. Learn more about our training.

.jpg?sfvrsn=950636e0_7)

The Delphi Difference

-

100 years of OE experience, supplier to the world’s top automakers

-

OE heritage and knowledge built into every aftermarket part

-

Comprehensive portfolio for a wide range of vehicles and model years

-

Streamlined SKUs for easy inventory management

-

Support through tools, tips and training

Related product resources and downloads

Resource Highlights

In this article, Delphi examines the recent downturn in diesel car sales and explains why, contrary to popular opinion, there’s still plenty of mileage left in the diesel fuel tank for both vehicle manufacturers and the independent aftermarket.

In the second of its three-part series, Delphi examines the recent downturn in diesel car sales and explains why, contrary to popular opinion, there’s still plenty of mileage left in the diesel fuel tank for both vehicle manufacturers and the independent aftermarket.

The fallout from numerous diesel emissions scandals throughout recent years continues to impact both consumer attitudes towards diesel, and its use in both passenger cars and light commercial vehicles. Yet this clean, efficient fuel, remains key to many automakers’ strategies in reducing CO2 emissions. Indeed, leading brands such as Ford, General Motors, BMW, Volkswagen, and Mercedes have recently pledged their commitment to diesel, firmly believing that it will coexist alongside petrol and electrified powertrains for many years to come.

Ford, for example, has recently introduced a diesel engine to the Ford Ka+ and a new 1.5L diesel for the EcoSport. General Motors, a new inline-six turbodiesel engine in the Chevrolet Silverado 1500 and GMC Sierra 1500. And Mercedes-Benz has rolled out a new generation of diesel engines across both their A, E, and S-Class models, investing three billion euros in research and production in the process.

Although Volkswagen’s “Dieselgate” may have triggered the crackdown on diesel engines, they too have reconfirmed the importance of diesel to their line-up. In 2018, they unveiled the EA288 Evo that features all the benefits of past TDI engines, without the harsh emissions. This newly developed four-cylinder, 2.0-liter turbodiesel engine, also compatible with a mild-hybrid setup, will power future VAG models, including Volkswagen, Audi, Skoda, and Seat.

Are diesel car sales declining?

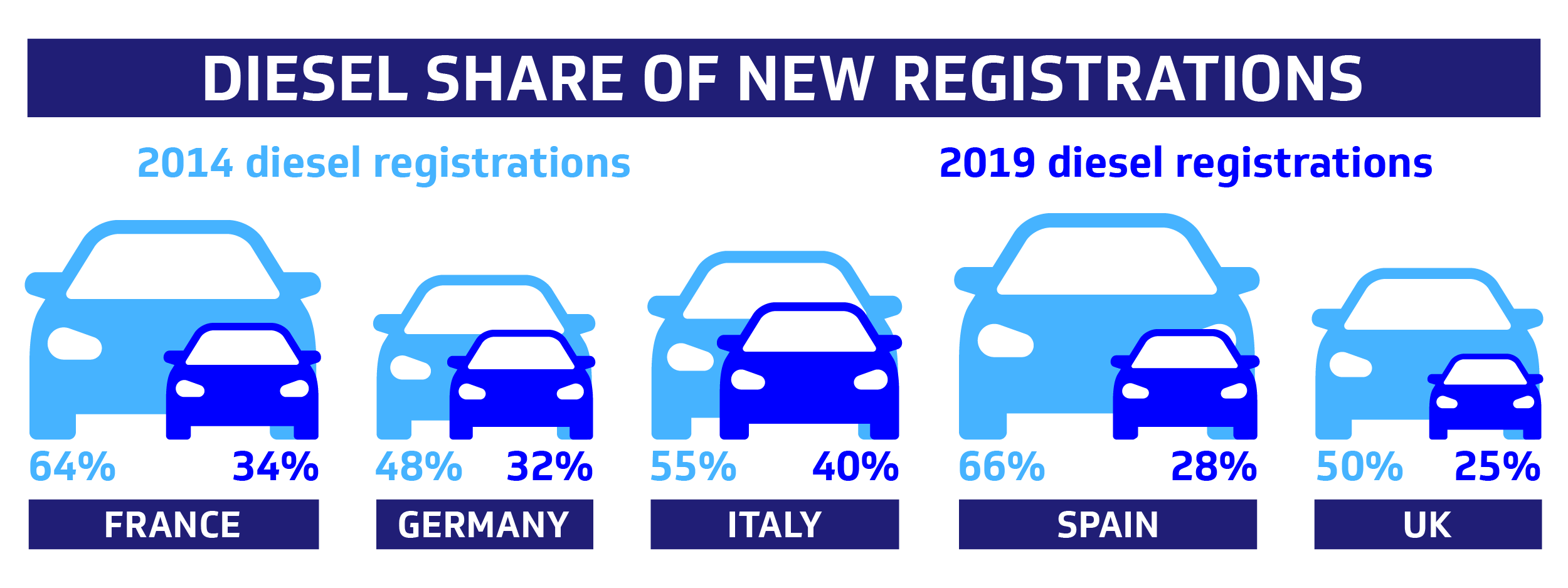

But whilst diesel is and will be, an important technology for many vehicle manufacturers, there’s no getting away from the impact that Dieselgate has had on the sales of new diesel cars. In only a few years, it has gone from being the most popular fuel type, with over 50% of the European market in 2015, to 32% in 2019 – still over a third of the market but its lowest level since the early 2000’s when diesel was just taking off. This trend is being seen in most other countries, albeit to varying degrees.

Take the big five markets, as an example. With a share of more than 70% back in 2010, much higher than the EU average, the French market fell to 34% in 2019, in part due to the French government leveling out taxes on diesel and gasoline fuel. Whilst less pronounced, the effect in Spain and the UK has been similar, with new diesel registrations falling to 28% and 25% respectively.

However, it’s not all bad news. The diesel parc in Italy continues to remain strong at 40% in 2019, and we see the biggest growth happening in Central and Eastern Europe. Remaining relatively untouched until 2017, when it fell to a low of 32% from near 50%, the share of diesel cars in Germany has shown signs of stabilizing since late 2019. Add in the fact that 4.5 million new diesel vehicles were registered in Europe in 2019, and it’s clear that despite the negative press, new diesel-powered vehicles continue to hit the European roads!

Source: ACEA

Growing aftermarket opportunities for passenger diesel

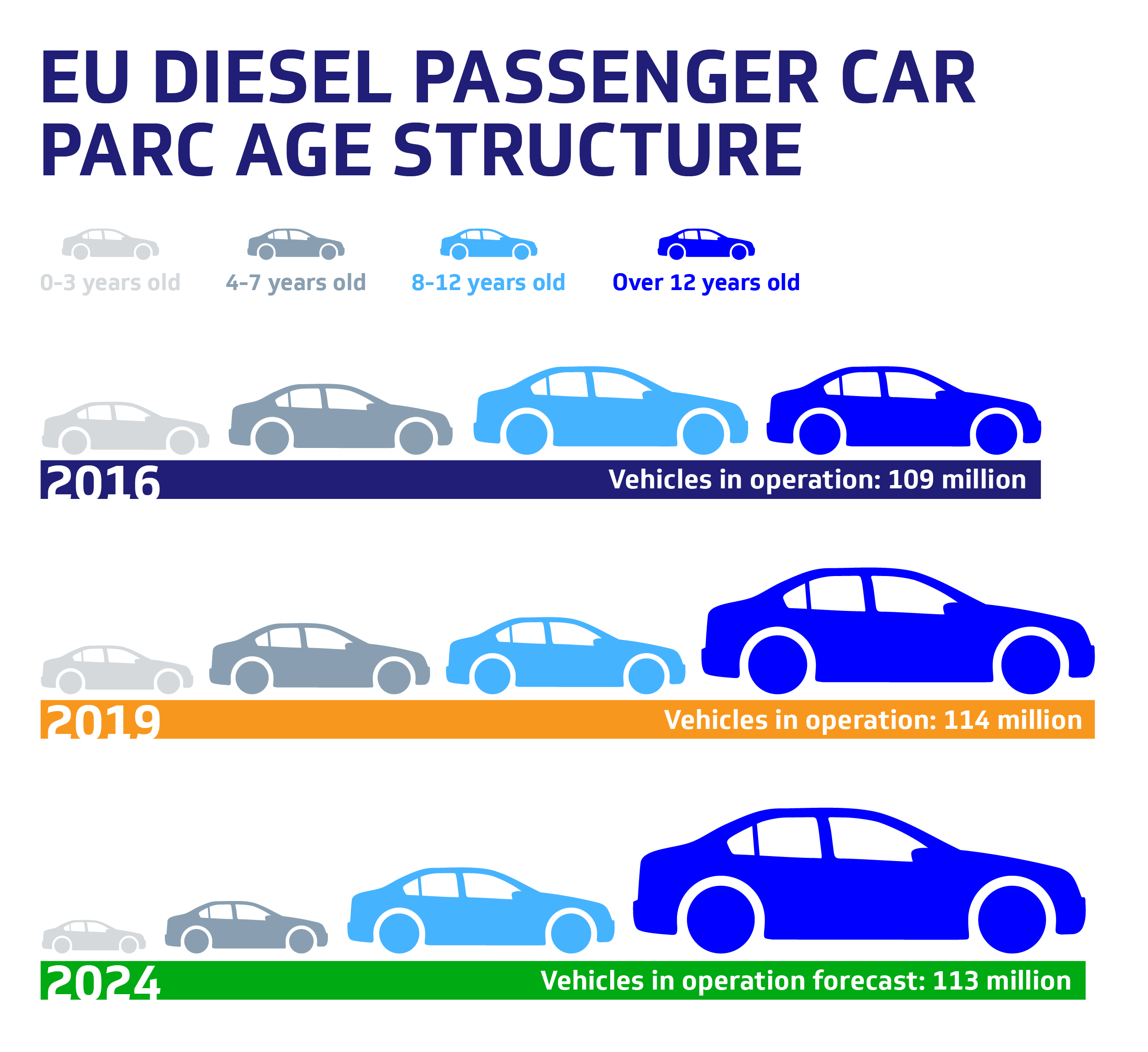

The news gets even better for the aftermarket. Whilst the decline in new diesel car sales may have been sudden, and in some cases sizeable, the impact won’t be felt for some time yet. In fact, service opportunity is still growing. How? Well, it’s all down to how the change has happened. And because it has been so quick, quicker than many would have expected, you don’t have to look too far back to see record numbers; only a few years ago, diesel accounted for over half of new car sales.

With the average life expectancy of a diesel car now exceeding 13 years and their average age currently at 6.7 years, they will have their prime service years ahead of them. Coupled with the fact that diesel cars are both relatively new, and still being purchased today, the diesel parc is not predicted to fade away from the aftermarket anytime soon. Parc data forecasts that by 2024 there will still be over 113 million diesel passenger cars on the road in Europe.

Source: IHS Markit

Today, there are still more than 15 million diesel vehicles less than 3 years of age on Europe’s roads. As these younger vehicles age, they will require more and more repairs, bringing significant opportunities for those that service them. For example, because the latest common rail injectors perform multiple injections and inject fuel into the engine at much higher pressures, through much smaller clearances, they are much more prone to wear and tear, resulting in more complex and costly repairs.

But it’s not just diesel fuel injection components that benefit. Diesel drivers, on average, do more miles than petrol users, creating additional opportunities for wear and tear repairs, which will only increase as the size of the diesel parc increases.

Logically, this creates more service opportunities for longer. When you add in a growing parc of medium and heavy-duty applications, where diesel still retains a significant share of the market, this will ensure a strong pipeline of diesel business for the aftermarket for at least the next 20 years and beyond. So, whilst the media might have you believe that it’s the end of the road for diesel, the reality is far from it. There’s still plenty of mileage left in the tank for diesel!

Get in touch

Find out where to buy Delphi parts